e wallet statistics malaysia

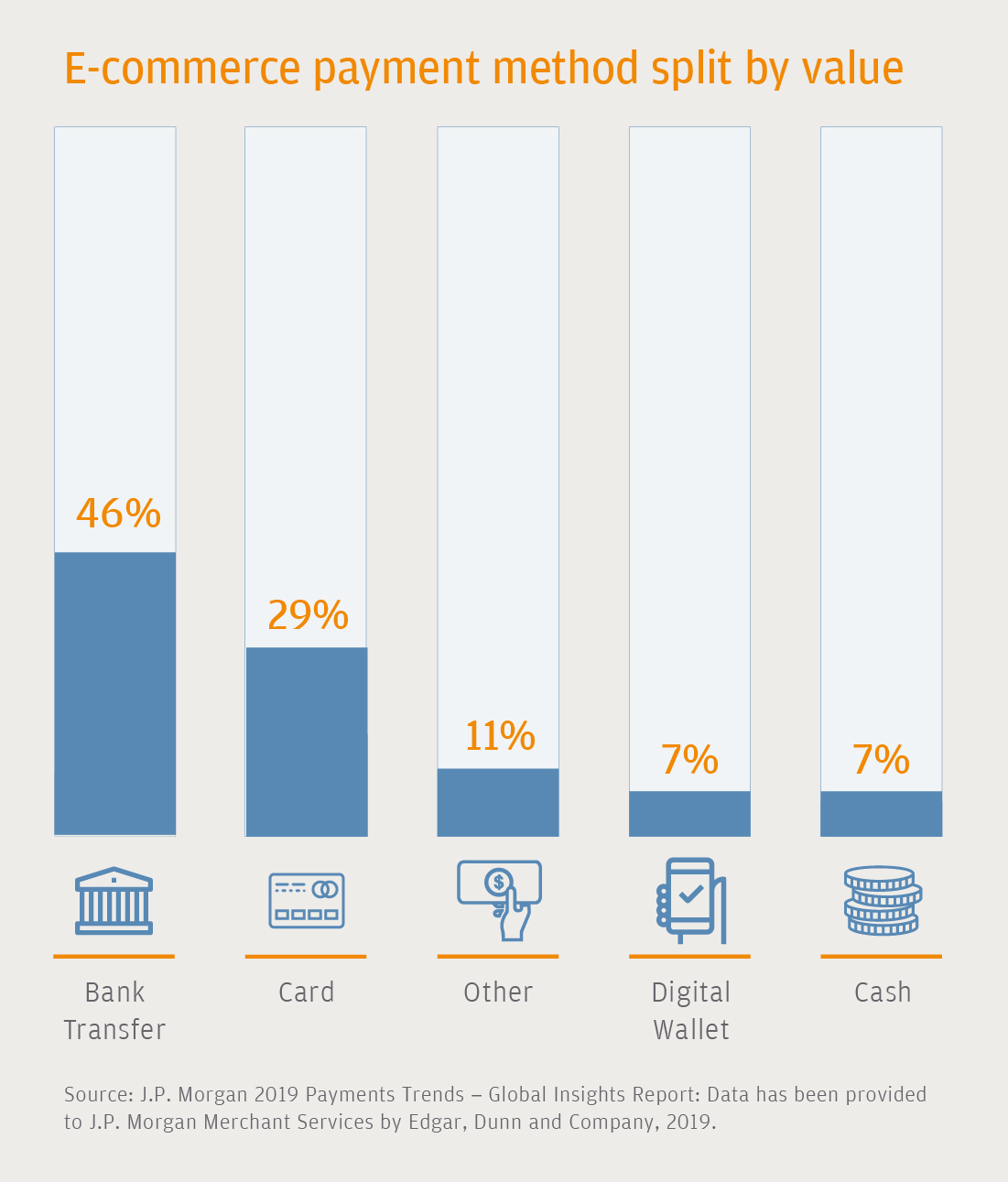

Use is expected to remain static to 2023. Bank transfers dominate as the primary e-commerce payment method in Malaysia accounting for 44 percent of all transactions.

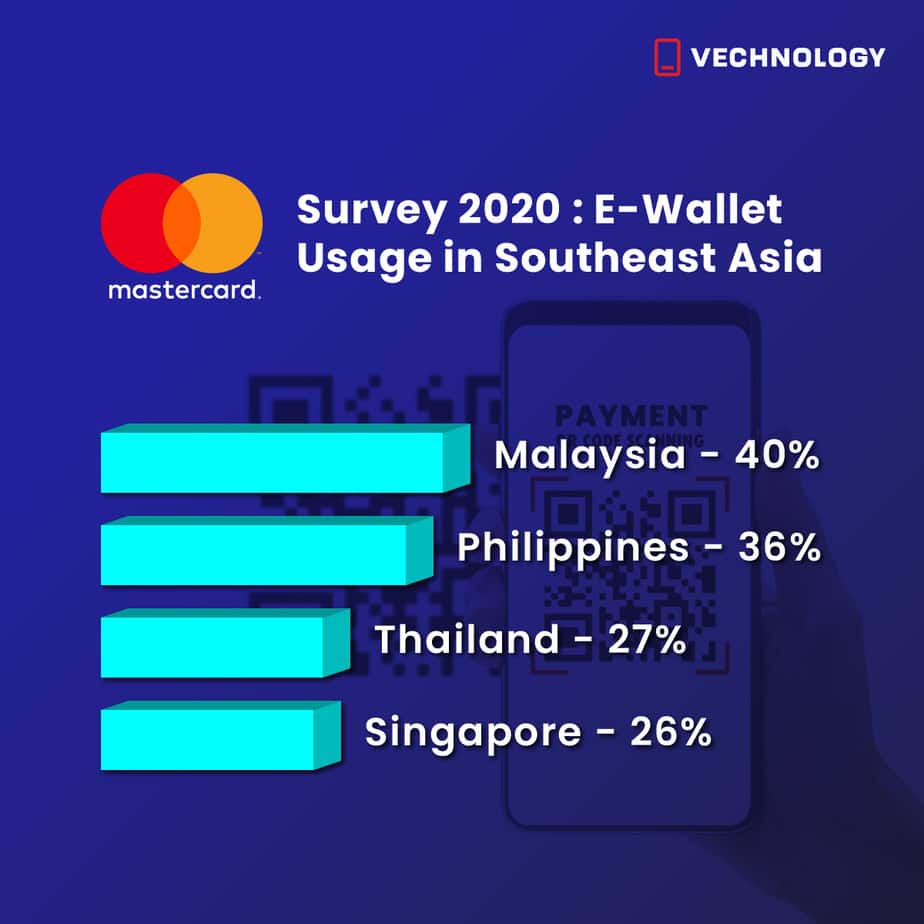

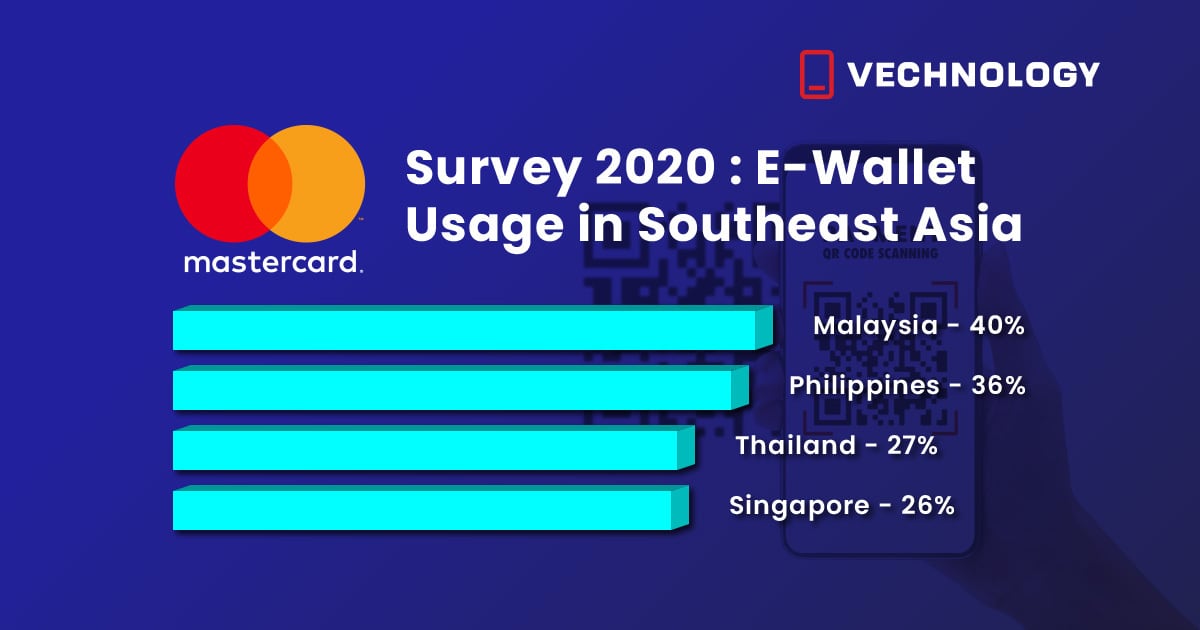

Malaysia Leads The Highest Usage Of E Wallet In Southeast Asia By Mastercard Survey 2020 Vechnology

Carousell one of the worlds largest and fastest growing classifieds marketplaces conducted a voluntary response in-app survey on e-wallets with its Malaysian users recently and found that there is a group that keeps more than.

. French opinion on e-wallet payments 2020 by type of opinion Number of active mobile wallets in France 2012-2018 French consumers degree. Oct 19 2021. Launched in 2017 its home to 7 million Boosties and growing.

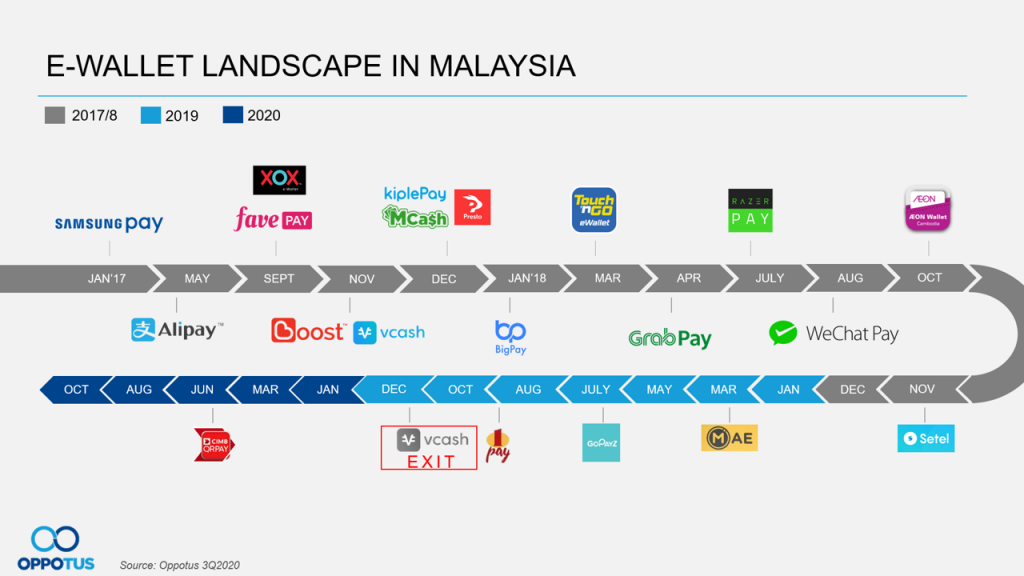

E-wallets have become such a phenomenon in Malaysia that even companies that didnt deal with payments before are jumping into wallets. E-Wallet Usage Trends in Malaysia 2021. It is a software-based system that securely stores users personal information account details and payment.

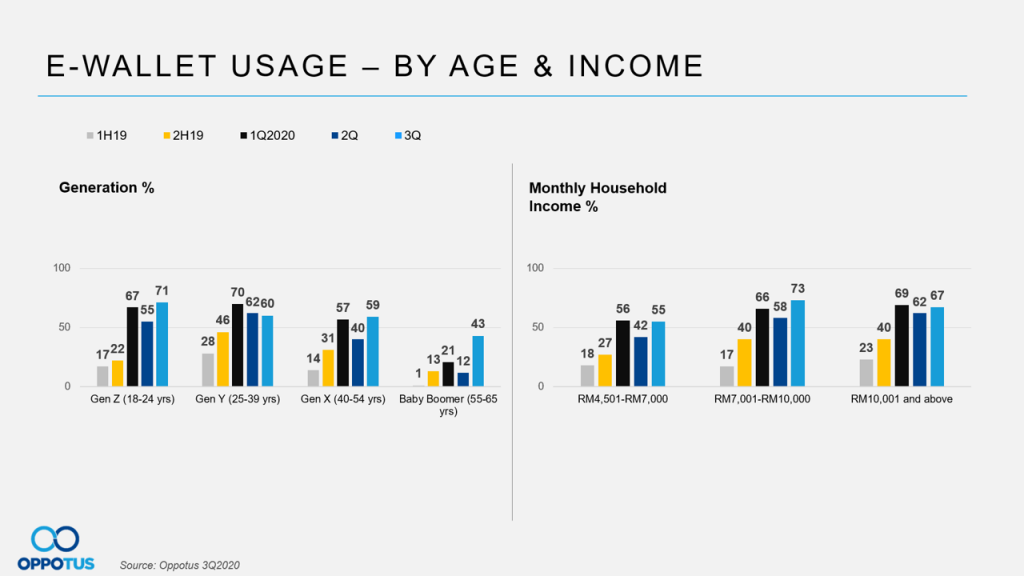

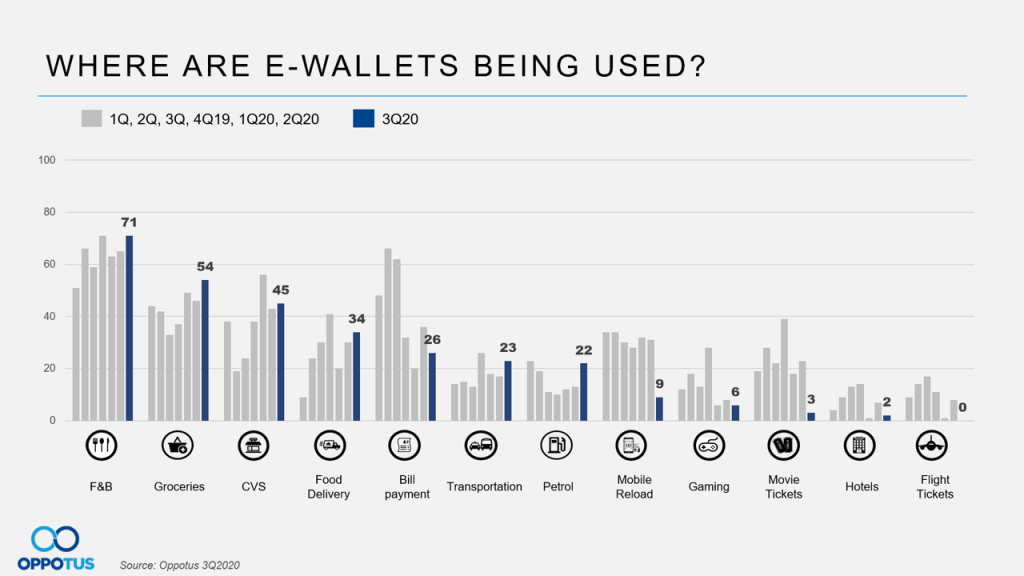

COVID-19 has brought significant changes to consumer lifestyles especially influencing Malaysian e-wallet usage in the past 2 years. With businesses across all sectors now slowly getting back on track and the Malaysians are ready to live in The New Normal we find e-wallet usage rising once again 66 3Q21. The e-wallet usage statistics by Carousell Malaysia.

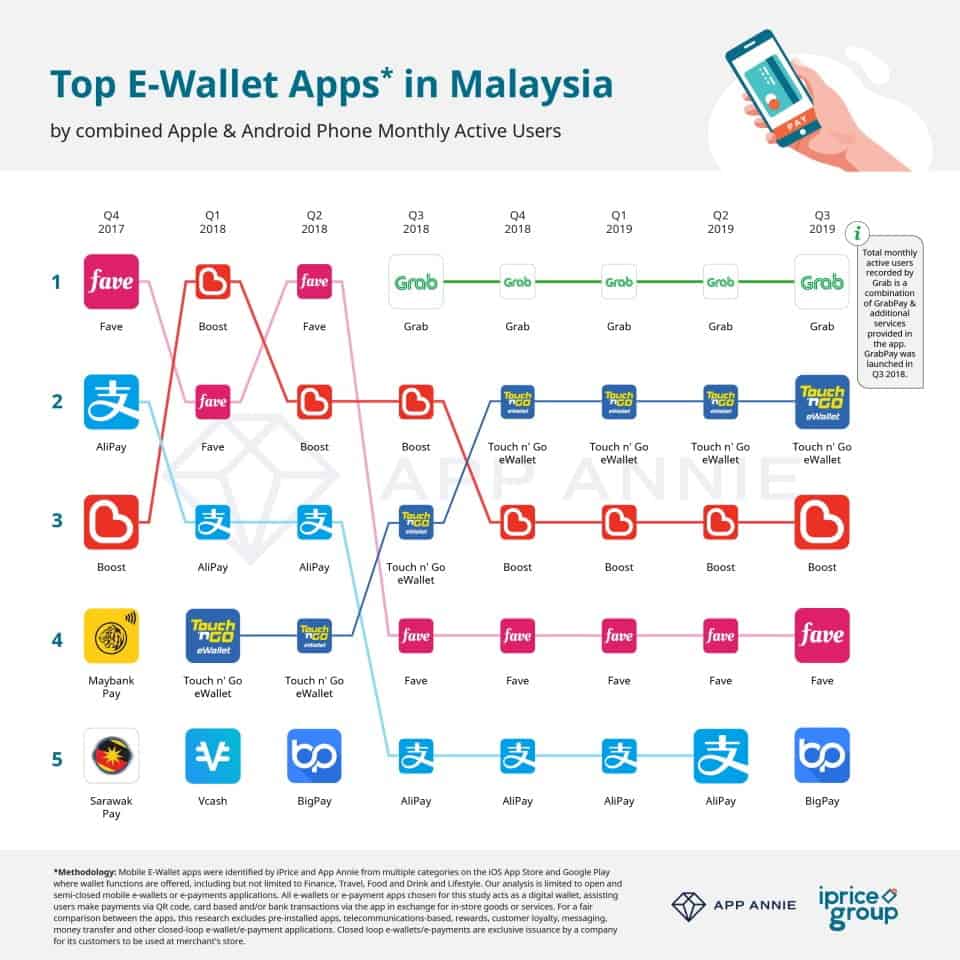

Mobile wallets GrabPay and Touch n Go are both expected to see their user number almost get doubled between 2020 and 2025. The Mastercard Impact Study 2020 found that Malaysia leads other countries in Southeast Asia when it comes to mobile or digital wallet usage. One-way ANOVA summarized results for effects of e-wallet by a ge are presented in table 6 below.

Generation X has also hit an all time high of 68 in 3Q21. Nov 4 2021. The ANOVA results indicate that F 9 371 3017 p.

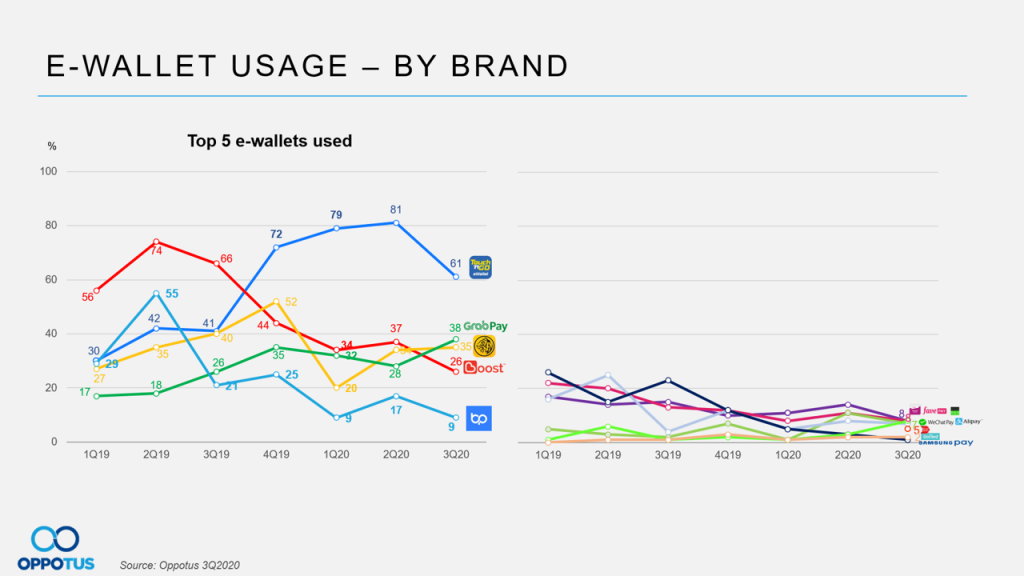

Another study regarding e-wallet trends in Malaysia by Oppotus found that 60 of the Malaysian customers have used an e-wallet in Q3 2020 which is more than double the number from 27 in Q3 2019. This shows that Malaysians are beginning to adopt e-wallet usage without the need for government incentives. In sheer numbers they are second only to payments companies.

Malaysia is regarded as a fast growing market for mobile. Bank transfers are the most-used e-commerce payment method in Malaysia accounting for almost. In the same survey.

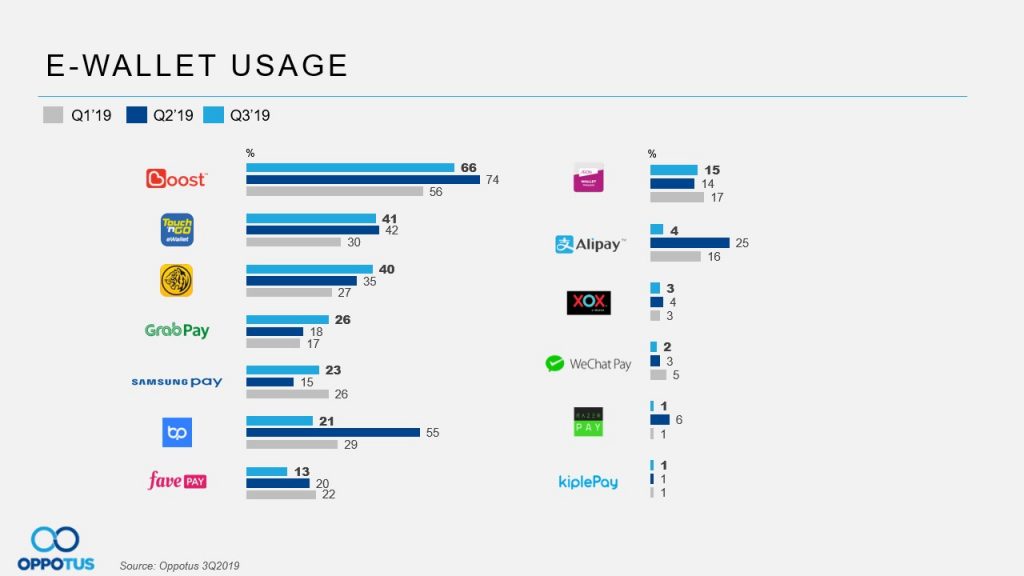

We just published a report revealing that 17 of Malaysias fintech companies are e-wallets. Over 50 of Carousellers are e-wallet users Grabpay Touch n Go and Boost lead the pack. The study also revealed that on average Malaysian customers used 2-3 e-wallets during Q3 2020.

Looking across the different age generations there is a strong increase 33 in e-wallet usage among Generation Y in 3Q21 compared to 2Q21. Users can use the e-wallet app to pay transfer money split and pay bills at. In the 21st century Malaysia is seeing an emerging trend in digitalisation and e-commerce also and to many as one of the revolutionary catalysts electronic wallets e-wallets.

March 25 2021 by Conventus Law. Malaysia has a mobile wallet usage of 40 ahead of other countries like the Philippines at 36 Thailand at 27 and Singapore at 26. Total of 330 data were collected from the users of e-wallet in the area of Klang Valley of Malaysia and analyzed by deploying partial least squares structural equation modeling PLS-SEM.

Boost is owned by Axiata Group. The input for the study was gathered from 10000 consumers and. 23 Bank penetration is at 85 percent 24 and domestic banks have launched a range of own-brand bank transfer options such as Maybank2u and CIMB Clicks which are widely used to pay domestic bills.

Boost is another dominant player in the e-wallet market with 170000 merchants and 75 million users. According to a survey by Rakuten Insight on e-payment usage about 824 percent of e-payment users indicated that they used Touch n Go for e-payment transactions. E-wallet market race.

Its CEO Mohd Khairil Abdullah pic said the growing awareness and leaps. French opinion on e-wallet payments 2020 by type of opinion Number of active mobile wallets in France 2012-2018 French consumers degree. Total transaction value in the Digital Payments segment is projected to reach US1822000m in 2022.

Boost The award-winning lifestyle e-wallet is one of the more notable players in the country partnering with 17 banks such as Maybank CIMB RHB Bank Public Bank Hong Leong Bank and many more. What Is E Wallet In Malaysia. Taking a closer look at the demographics of Malaysian e-wallet users we find that e-wallets are most commonly used amongst the 25-34 age group with the 35-44 age group also having a solid percentage of e-wallet users at 25.

While queueing to pay for my drinks at a coffee outlet recently I observed 80 per cent of customers paid by just waving their bank cards while some used their mobile phones to scan a QR code that deducts money from their e-wallet.

Malaysia Leads The Highest Usage Of E Wallet In Southeast Asia By Mastercard Survey 2020 Vechnology

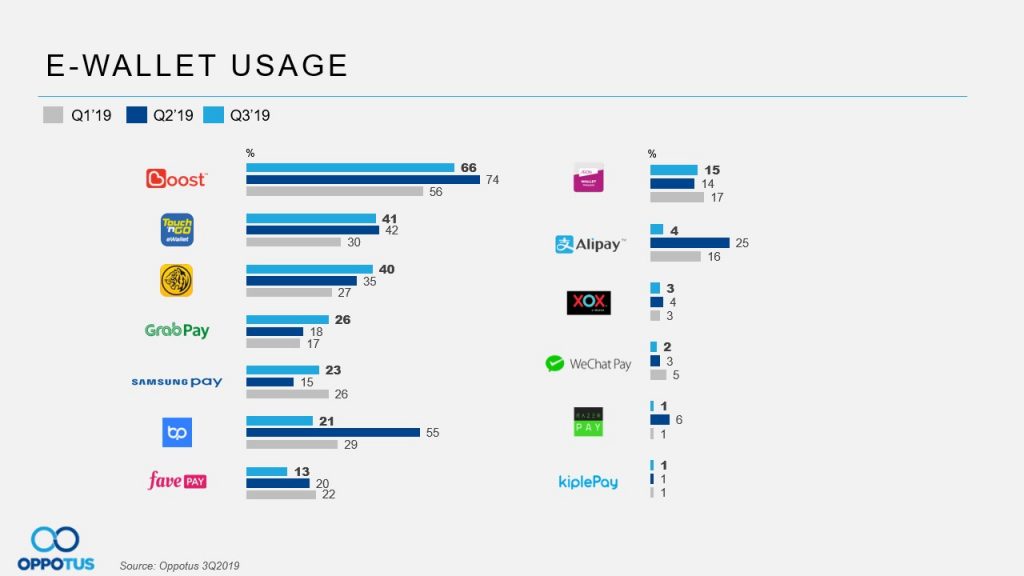

Navigating The E Wallet Landscape Of Malaysia Oppotus

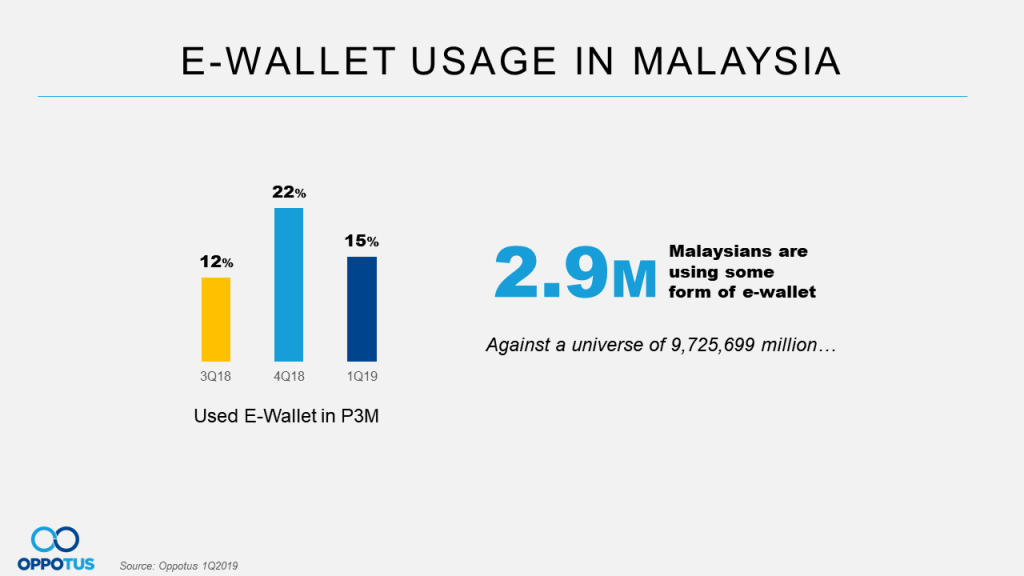

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Money In Malaysia Source Bank Negara Malaysia Statistics Download Scientific Diagram

Biggest E Wallet Trends In Malaysia Sticpay

Malaysia Frequency Of E Payment Use By Age 2020 Statista

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Money Transactions In Nov 2021 Highest In Five Years The Edge Markets

Carousell Survey Finds An Increase In E Wallet Users In Malaysia

E Wallets In Malaysia Landscape At The End Of 2019 Oppotus

Malaysia Mobile Payment Users 2025 Statista

4 Most Popular E Commerce Payment Methods In Malaysia

Malaysian E Wallet Usage As We Move Towards Recovery 2021 Oppotus

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

E Wallet Usage In Malaysia 2020 Thriving In Lockdown Oppotus

Fintech Malaysia Report 2018 The State Of Play For Fintech Malaysia Fintech News Malaysia

No comments for "e wallet statistics malaysia"

Post a Comment