private retirement scheme malaysia review

Permanent departure from Malaysia. You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4.

Prs Malaysia 2019 Review Should You Really Invest

Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may.

. In order to ensure the welfare of retirees upon reaching retirement. In addition PRS funds are also allowed to invest in exchange-traded-funds based on physical gold to increase asset diversification into alternative investments the commission. Currently only Class A is available for subscription through PPA PRS Online.

Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your contribution time horizon risk appetite and age. I announced a tax relief up to RM6000 for EPF and life insurance be extended to the Private Pension Fund now known as Private Retirement Scheme. Build Your Future With a Firm that has 85 Years of Retirement Experience.

KUALA LUMPUR Feb 21. Securities Commission Malaysia SC chairman Tan Sri Ranjit Ajit Singh recently announced that the total AUM of the existing 56 PRS funds rose some 47 to close the year at RM223 billion up from RM151 billion in 2016. Morningstar regularly reviews the category structure.

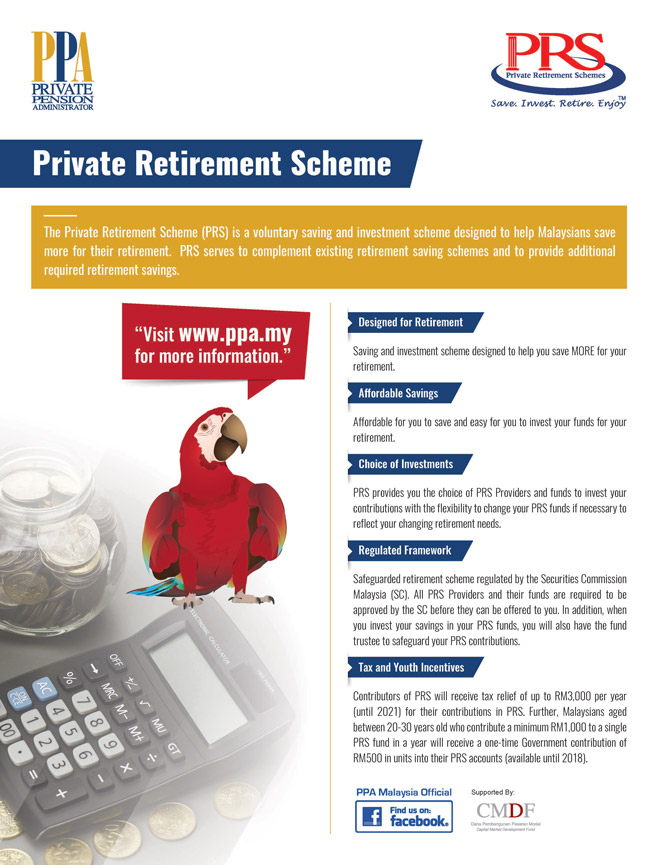

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Funds under PRS are. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement.

The Morningstar Categories for funds in the Malaysia Private Retirement Scheme universe were first established shortly after the establishment of the initiative by the Malaysian Government to help investors make meaningful comparisons between Investment funds. 2 Manulife Investment Management M Berhad. Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence.

The Securities Commission Malaysia SC announced today that conservative funds under the Private Retirement Scheme can now invest in foreign markets. Additionally the Malaysian Governments Budget 2012 specifies a tax relief of up to RM3000 for 10 years beginning 2012 for contributions to the PRS. In the 2011 Budget.

To encourage saving for retirement the RM3000 tax relief on Private Retirement Scheme PRS contributions has been extended until YA 2025 said Tengku Zafrul Aziz at the tabling of Budget 2021 today. To ensure private sector employee and self-employed to have sufficient savings upon retirement. The voluntary retirement savings scheme which was launched six years ago saw a record 301279 members last year a 36.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Morningstar Analysts 28022014. Each PRS offers a choice.

Having a voluntary scheme in addition to the EPF also allows private company employees and self-employed persons to voluntarily contribute towards their retirement in a systematic way.

A Retirement Plan For The Self Employed Prs Live

Deciphering The Top 10 Performing Growth Category Prs Funds I3investor

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Pdf The Awareness Of Private Retirement Scheme And The Retirement Planning Practices Among Private Sector Employees In Malaysia

Taking Charge Of Your Retirement Is Good For You Prs Live

Private Retirement Scheme In Malaysia Dividend Magic

Prs Malaysia 2019 Review Should You Really Invest

Prs Malaysia 2019 Review Should You Really Invest

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

How To Choose The Best Private Retirement Scheme Malaysia

I Ran The Numbers On All 57 Prs Funds And Found That Only 1 Beats The Asb Returns And 6 Beats The Epf Returns Consistently After Fees Not The Greatest Odds So

How To Choose The Best Private Retirement Scheme Malaysia

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Prs Malaysia 2019 Review Should You Really Invest

Prs Malaysia 2019 Review Should You Really Invest

A Guide To The Private Retirement Scheme Prs

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

No comments for "private retirement scheme malaysia review"

Post a Comment